Credit Suisse Rescue Brings Short-Lived Relief as Bank Shares Plummet

On Monday, there was a sharp decline in banking stocks and bonds following the announcement of UBS Group AG’s acquisition of Credit Suisse Group AG. The deal was orchestrated by Swiss regulators in an attempt to restore confidence in the sector, and UBS will pay 3 billion Swiss francs ($3.23 billion) for Credit Suisse and assume up to $5.4 billion in losses. Credit Suisse shares fell 62%, while UBS lost 7.1%. This came after a day of heavy selling in Asian financial markets, where investor optimism about official efforts to stem a banking crisis quickly evaporated.

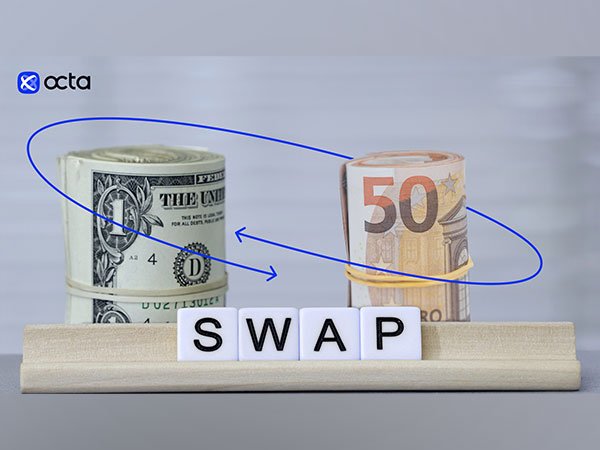

Investor focus has shifted to the massive hit that some Credit Suisse bondholders would take under the UBS acquisition, which has added to anxiety about other key risks, including contagion, the fragile state of U.S. regional banks, and the challenges for central banks as they seek to contain inflation and financial risks. The Swiss regulator decided that Credit Suisse’s additional tier-1 bonds (AT1 bonds), with a notional value of $17 billion, will be valued at zero, angering some of the holders of the debt who thought they would be better protected than shareholders in the takeover deal. Credit Suisse’s AT1 bonds dropped sharply in early European trade, with a number of dollar-denominated issues being bid at 2 cents on the dollar.

The shotgun Swiss banking marriage is backed by a massive government guarantee, helping prevent what would have been one of the largest banking collapses since the fall of Lehman Brothers in 2008. Monetary authorities in Singapore and Hong Kong, where Credit Suisse hosts large regional offices, separately said the Swiss bank’s business continued without interruption. Credit Suisse urged its staff to go to work, according to a memo to staff seen by Reuters.

However, problems remain in the U.S. banking sector, where bank stocks remained under pressure despite a move by several large banks to deposit $30 billion into First Republic Bank, an institution rocked by the failures of Silicon Valley and Signature Bank. On Sunday, First Republic saw its credit ratings downgraded deeper into junk status by S&P Global, which said the deposit infusion may not solve its liquidity problems.

There are also concerns about what happens next at Credit Suisse and what that means for investors, clients, and employees. The deal will make UBS Switzerland’s only global bank and the Swiss economy more dependent on a single lender. UBS chairman Kelleher told a media conference that it will wind down Credit Suisse’s investment bank, which has thousands of employees worldwide. UBS said it expected annual cost savings of some $7 billion by 2027.

“The Credit Suisse debacle will have serious ramifications for other Swiss financial institutions. A country-wide reputation with prudent financial management, sound regulatory oversight, and, frankly, for being somewhat dour and boring regarding investments, has been wiped away,” said Octavio Marenzi, CEO of Opimas, in Vienna.