Finuit’s Bank Statement Analyzer simplifies processing of MSME Loan Applications

There are over 6.3 million MSMEs in India, with an unmet credit demand of close to 120 billion USD. Access to small ticket loans for MSMEs is often a long, uncertain process. MSME lending landscape faces challenges of credit underwriting necessary for the approval and disbursal of loans. Credit underwriting requires the applicant’s financial data from a myriad of documents such as balance sheets, cashflow, and income statements, to gauge the risk and financial health of the applicant. MSMEs often lack documentation and have a limited credit history which makes it difficult for lenders to process their loan applications.

Many fintech companies work with lenders to enhance lending processes through digital lending, loan origination systems, and automation by leveraging ML and intelligent systems. However, MSME lenders struggle to adopt such systems which work with standard, exhaustive documentation for credit underwriting. MSME lenders have to rely on year-long bank statements to analyze the financial health of their applicants. These bank statements run into hundreds of pages due to low-value transactions and often across different bank accounts. The credit operations teams of such lenders take an average of 1-2 days to analyze these bank statements. Therefore, MSME lenders need faster processing systems to address the underserved MSME segment.

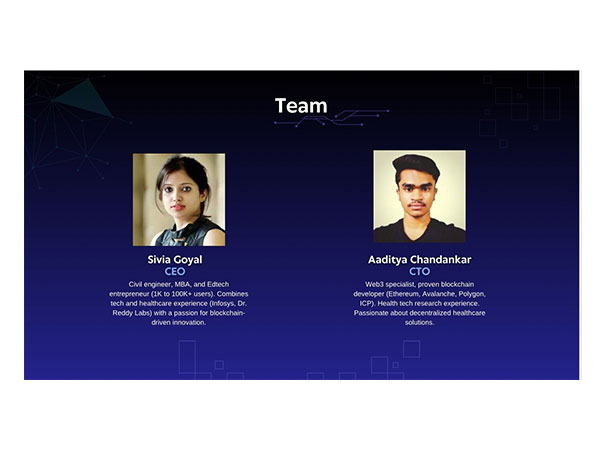

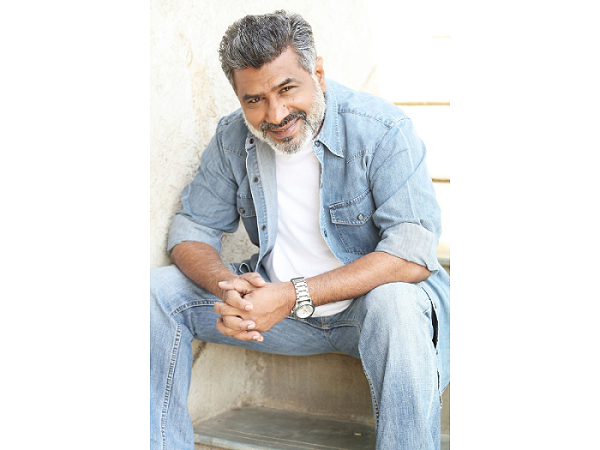

Finuit, a fintech division of Quantrium, worked in the past year with a growing regional MSME lender in Tamil Nadu to study their underwriting process. They developed a suite of intelligent document processing tools attending to the specific needs of MSME lenders based on the documents available, such as balance sheets, bank statements, profit and loss statements, etc. Arun S Iyer, Business Head of Finuit, said, “The MSME lending needs are complex. We built a solution that is versatile enough to tackle unstructured financial data across multiple data sources. The overall objective was to make the process of gleaning crucial insights from bank statements faster and simpler. We achieved it by integrating AI, NLP tools and analytical capabilities”.

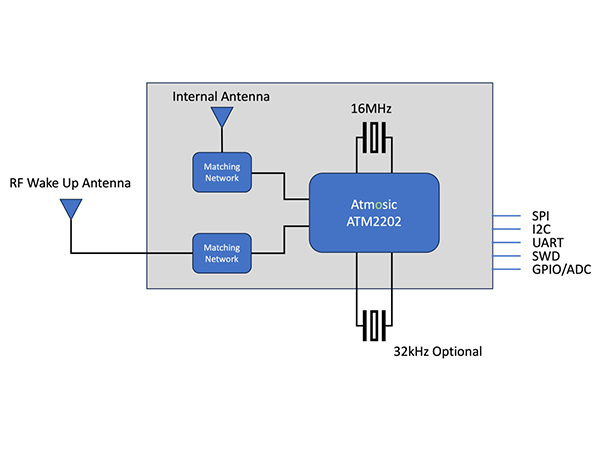

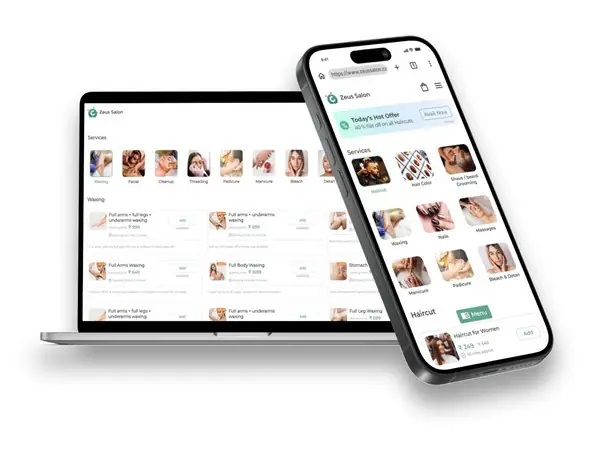

Finuit’s Bank Statement Analyzer processes bank statements to enable faster credit decision and underwriting processes. The analyzer leverages AI and ML technology to extract data from bank statements of the applicant’s bank accounts to analyze key credit indicators such as earning and spending patterns, unusual or irregular transfers, identifying suppliers and distributors, etc. The Bank Statement Analyzer’s user-friendly interface processes images of bank statements and passbooks across multiple bank accounts to derive the cash flow stories of the applicant within 5 minutes.

The bank statement solution offers authoritative creditworthiness indicators such as income and spending patterns, unusual or irregular transfers, and supplier and distributor payments. The Bank Statement Analyzer uses an in-house trained, dedicated LLM for identifying key pieces of information from transaction particulars, such as, Counterparty, Transfer Type, Counterparty Type, UPI IDs etc. The income and spending patterns are identified from the particulars and information extracted, through a ML model.

M V Ramarao, Product Manager at Finuit elaborates,”To ensure the solution produces accurate and reliable results, we have established hundreds of rules. These rules are meticulously designed to guide the solution, enhancing its ability to deliver precise transaction classifications and insights.”

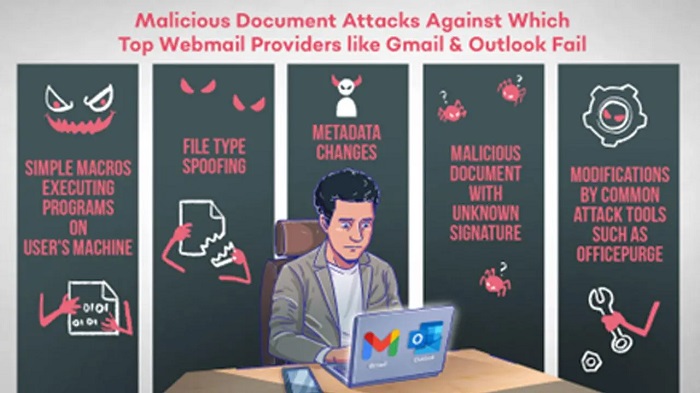

Finuit uses data encryption measures to ensure data integrity and confidentiality. There are strict access controls in place, to protect data from potential breaches. As an evolving fintech company, they continuously explore newer security measures and mechanisms to update their security protocols.

“A significant reduction in processing time without the need for additional resources was what we were aiming at. And our clients are delighted with the results. They complete within two days what used to take a week”, said Ramarao.

Conclusion:

Finuit is the fintech division of Quantrium, a bootstrapped AI-ML IT services and products company headquartered in Chennai, India. Finuit specializes in building innovative AI-powered applications for global organizations. The company is led by accomplished professionals with decades of expertise. Finuit’s Document Intelligence suite includes Financial Statement Analyzer, Payslip Analyzer, Passbook Analyzer, Company Deep Forensics Tool, and KYC Validator, solutions that address the business-critical needs of the financial services industry.